Shortchanged Life and Debt in the Fringe Economy: Unraveling the Hidden Struggles in Society's Underserved Margins

In the bustling tapestry of modern society, there exists a hidden underbelly where countless individuals navigate a treacherous path of financial precarity and social exclusion. This fringe economy, often shrouded in invisibility, harbors a multitude of challenges that profoundly impact the lives of those dwelling within its confines. One of the most pervasive and debilitating aspects of this marginalized existence is the crushing weight of debt.

The Allure and Perils of Fringe Banking

For those excluded from traditional banking systems, fringe financial institutions often serve as a lifeline. However, these institutions typically charge exorbitant interest rates and engage in predatory lending practices that trap borrowers in a cycle of perpetual indebtedness. Payday loans, for example, offer quick access to cash but come with interest rates that can reach up to 400%. Similarly, title loans, secured against the borrower's vehicle, often result in exorbitant repossession fees.

5 out of 5

| Language | : | English |

| File size | : | 989 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 351 pages |

| Lending | : | Enabled |

The Impact of Debt on Health and Well-being

The burden of debt in the fringe economy has dire consequences for physical and mental health. Studies have linked financial stress to increased risk of heart disease, stroke, depression, and anxiety. Moreover, the constant fear of defaulting on loans can lead to chronic sleep deprivation, undermining cognitive function and overall well-being.

Social Exclusion and Stigma

Debt in the fringe economy also perpetuates social exclusion and stigma. Individuals struggling with debt may withdraw from society due to shame or fear of judgment. This isolation can exacerbate their financial difficulties and further undermine their health and well-being. Furthermore, the association of debt with moral failure or personal irresponsibility creates a societal stigma that further marginalizes those in need.

Policy Failures and Systemic Inequities

The prevalence of debt in the fringe economy is a symptom of broader policy failures and systemic inequities. The lack of affordable housing, the erosion of social safety nets, and the rise of precarious employment have all contributed to the growth of this hidden underclass. Additionally, deregulation of the financial industry has allowed for the proliferation of predatory lenders who prey on the vulnerabilities of these marginalized communities.

Strategies for Empowerment and Economic Justice

Addressing the shortchanged lives and debt burden faced by the fringe economy requires multifaceted interventions that promote economic empowerment and social justice. These include:

*

Expanding Access to Affordable Housing:

Secure and affordable housing is essential for financial stability. Government subsidies, rent control, and the promotion of community land trusts can make housing more accessible for low-income individuals. *

Creating Job Opportunities and Supporting Skills Development:

Stable employment is fundamental to financial well-being. Investment in infrastructure, worker cooperatives, and workforce training programs can generate employment opportunities and enhance earning potential. *

Regulating Fringe Financial Institutions:

Strong consumer protection laws are needed to prevent predatory lending practices and ensure fair access to financial services. Interest rate caps, stricter lending criteria, and increased transparency are all essential measures. *

Expanding Social Safety Nets:

Social programs such as food assistance, healthcare subsidies, and unemployment benefits can provide a lifeline for those struggling to make ends meet. These programs need to be adequately funded and accessible to all in need. *

Promoting Financial Literacy and Empowerment:

Education initiatives can equip individuals with the knowledge and skills to manage their finances effectively. Financial counseling, budgeting workshops, and credit repair services can empower individuals to break the cycle of debt.

The fringe economy is a hidden epidemic that perpetuates financial precarity and social exclusion for marginalized communities. The crushing weight of debt in this underserved sector not only undermines individual well-being but also perpetuates systemic inequities. To truly address this issue, policymakers must prioritize economic justice and implement comprehensive strategies that expand access to affordable housing, create job opportunities, regulate fringe financial institutions, expand social safety nets, and promote financial literacy. By empowering those in the fringe economy, we can create a more just and equitable society where all individuals have the opportunity to live a life of financial security and dignity.

Image Alt Text: A person sits at a desk, head in hands, unable to make ends meet due to the overwhelming burden of debt.

5 out of 5

| Language | : | English |

| File size | : | 989 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 351 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Genre

Genre Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Sentence

Sentence Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Footnote

Footnote Manuscript

Manuscript Codex

Codex Narrative

Narrative Biography

Biography Memoir

Memoir Reference

Reference Dictionary

Dictionary Thesaurus

Thesaurus Character

Character Resolution

Resolution Card Catalog

Card Catalog Stacks

Stacks Research

Research Scholarly

Scholarly Lending

Lending Reserve

Reserve Academic

Academic Journals

Journals Reading Room

Reading Room Special Collections

Special Collections Interlibrary

Interlibrary Study Group

Study Group Storytelling

Storytelling Awards

Awards Book Club

Book Club Theory

Theory Ranveer Patel

Ranveer Patel Ann Weisgarber

Ann Weisgarber Eric Leif Davin

Eric Leif Davin Elizabeth Lane

Elizabeth Lane Samantha Kwan

Samantha Kwan Jonathan Rieder

Jonathan Rieder Erich Ebel

Erich Ebel Dani Redd

Dani Redd Charise Randell

Charise Randell James Hendricks

James Hendricks Colleen Mccullough

Colleen Mccullough Douglas Stuart

Douglas Stuart Jack W Lewis

Jack W Lewis Mimi Thi Nguyen

Mimi Thi Nguyen Alice J Wisler

Alice J Wisler Jason J Nugent

Jason J Nugent Donal Daly

Donal Daly Mackenzi Lee

Mackenzi Lee Robin Adolphs

Robin Adolphs Howard Ball

Howard Ball

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

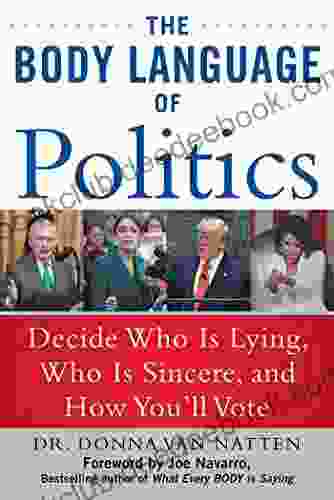

Julian PowellDecide Who Is Lying, Who Is Sincere, And How You'll Vote: A Comprehensive...

Julian PowellDecide Who Is Lying, Who Is Sincere, And How You'll Vote: A Comprehensive... Thomas PynchonFollow ·17.8k

Thomas PynchonFollow ·17.8k Gene PowellFollow ·12k

Gene PowellFollow ·12k Charles ReedFollow ·9k

Charles ReedFollow ·9k Branson CarterFollow ·14k

Branson CarterFollow ·14k Rudyard KiplingFollow ·3.2k

Rudyard KiplingFollow ·3.2k Quentin PowellFollow ·2.1k

Quentin PowellFollow ·2.1k Heath PowellFollow ·9.8k

Heath PowellFollow ·9.8k Roland HayesFollow ·3.2k

Roland HayesFollow ·3.2k

Ralph Waldo Emerson

Ralph Waldo EmersonBWWM Enemies to Lovers Billionaire Romance: A Captivating...

In the realm of romance novels, the...

Maurice Parker

Maurice ParkerJohn Adams and the Fear of American Oligarchy

John Adams, a...

Bryce Foster

Bryce FosterTo Die but Once: A Haunting Maisie Dobbs Novel

Synopsis ...

Manuel Butler

Manuel ButlerCommunication Research Measures Sourcebook Routledge...

Communication research measures are the...

5 out of 5

| Language | : | English |

| File size | : | 989 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 351 pages |

| Lending | : | Enabled |