The Entrepreneurial Bible to Venture Capital: A Comprehensive Guide

4.5 out of 5

| Language | : | English |

| File size | : | 1587 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 257 pages |

| Screen Reader | : | Supported |

| X-Ray | : | Enabled |

Venture capital is a powerful tool that can help entrepreneurs turn their dreams into reality. But the world of venture capital can be complex and challenging to navigate. That's why we've written this comprehensive guide to help you understand everything you need to know about venture capital, from the basics to the most advanced strategies.

In this book, you'll learn:

* What venture capital is and how it works * The different types of venture capital firms * How to prepare a pitch deck that will get investors excited * How to negotiate the best possible terms with venture capitalists * How to manage your relationship with your investors * How to exit your business successfully

Whether you're just starting out on your entrepreneurial journey or you're looking to take your business to the next level, this book has something for you. So sit back, relax, and let us guide you through the world of venture capital.

Chapter 1: What is Venture Capital?

Venture capital is a type of investment that is provided to early-stage companies with high growth potential. Venture capitalists typically invest in companies that are developing new products or technologies, or that are expanding into new markets.

Venture capital is different from other types of investment in that it is typically provided in the form of equity, rather than debt. This means that venture capitalists own a piece of your company in exchange for their investment.

There are many different types of venture capital firms, each with its own investment strategy. Some venture capital firms focus on investing in early-stage companies, while others focus on investing in later-stage companies. Some venture capital firms specialize in investing in certain industries, such as technology or healthcare.

Chapter 2: The Different Types of Venture Capital Firms

There are many different types of venture capital firms, each with its own investment strategy. Some of the most common types of venture capital firms include:

* Seed-stage venture capital firms invest in companies that are in the early stages of development. These companies typically have not yet generated any revenue and may not have a product or service that is ready for market. * Series A venture capital firms invest in companies that have generated some revenue and have a product or service that is ready for market. These companies are typically looking to raise capital to expand their operations or enter new markets. * Series B venture capital firms invest in companies that have reached a certain level of maturity and are looking to raise capital for growth or expansion. These companies typically have a proven business model and are generating significant revenue. * Late-stage venture capital firms invest in companies that are looking to raise capital for acquisitions, expansion, or an initial public offering (IPO). These companies are typically mature and have a strong track record of success.

Chapter 3: How to Prepare a Pitch Deck that Will Get Investors Excited

A pitch deck is a presentation that you will use to pitch your business to potential investors. It is one of the most important tools in your fundraising arsenal, so it is important to make sure that it is well-prepared and executed.

Here are some tips for preparing a pitch deck that will get investors excited:

* Start with a strong hook. Your hook is the first thing that investors will see, so make sure that it is attention-grabbing and relevant to your business. * Tell a clear and concise story. Your pitch deck should tell a clear and concise story about your business, from the problem that you are solving to the solution that you are offering. * Use data to support your claims. Investors want to see data that supports your claims about your business. This could include data on your market size, your target customers, or your financial projections. * End with a strong call to action. Your call to action should tell investors what you want them to do, such as invest in your business or join your team.

Chapter 4: How to Negotiate the Best Possible Terms with Venture Capitalists

Once you have found a venture capital firm that is interested in investing in your business, you will need to negotiate the terms of the investment. This is a complex process, but it is important to remember that you are in a position of strength. Venture capitalists want to invest in your business, so you should not be afraid to negotiate for the best possible terms.

Here are some tips for negotiating the best possible terms with venture capitalists:

* Understand your own valuation. Before you start negotiating, it is important to understand your own valuation. This will give you a good starting point for negotiations. * Be prepared to walk away. If venture capitalists are not willing to meet your terms, be prepared to walk away. There are other venture capital firms out there, and you do not want to accept terms that are not in your best interests. * Get everything in writing. Once you have reached an agreement with a venture capital firm, it is important to get everything in writing. This will protect you both in the event of a dispute.

Chapter 5: How to Manage Your Relationship with Your Investors

Once you have closed a deal with a venture capital firm, it is important to manage your relationship with your investors carefully. Venture capitalists can be a valuable source of support and advice, but they can also be demanding.

Here are some tips for managing your relationship with your investors:

* Keep them informed. Keep your investors informed about your progress on a regular basis. This will help them to understand how your business is ng and to make informed decisions about whether or not to continue investing. * Be responsive to their requests. Investors will often have requests for information or meetings. Be responsive to their requests and provide them with the information they need. * Build a relationship. Venture capital is a relationship-based business. Take the time to build a relationship with your investors and get to know them on a personal level.

Chapter 6: How to Exit Your Business Successfully

When you start a business, you may not think about exiting it. But it is important to have a plan for your exit early on. This will help you to maximize the value of your business and to avoid any surprises down the road.

There are many different ways to exit a business, including:

* Selling your business to another company. This is the most common way to exit a business. * Taking your business public. This can be a good way to raise capital and to increase the value of your business. * Merging with another company. This can be a good way to combine resources and to create a stronger business. * Closing your business. This is the least desirable option, but it may be necessary if you are unable to find a buyer or to take your business public.

Venture capital can be a powerful tool for entrepreneurs, but it is important to understand how it works before you get started. This comprehensive guide will help you to understand everything you need to know about venture capital, from the basics to the most advanced strategies.

With the right knowledge and preparation, you can use venture capital to take your business to the next level.

4.5 out of 5

| Language | : | English |

| File size | : | 1587 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 257 pages |

| Screen Reader | : | Supported |

| X-Ray | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Bookmark

Bookmark Shelf

Shelf Synopsis

Synopsis Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Tome

Tome Classics

Classics Narrative

Narrative Biography

Biography Memoir

Memoir Dictionary

Dictionary Thesaurus

Thesaurus Character

Character Resolution

Resolution Librarian

Librarian Catalog

Catalog Card Catalog

Card Catalog Archives

Archives Periodicals

Periodicals Research

Research Scholarly

Scholarly Lending

Lending Reserve

Reserve Academic

Academic Literacy

Literacy Storytelling

Storytelling Theory

Theory Mary Hogan

Mary Hogan Allie Aller

Allie Aller P V Kannan

P V Kannan Kreshnik Bali

Kreshnik Bali Andrea Beaty

Andrea Beaty Wray Vamplew

Wray Vamplew Judith Skillman

Judith Skillman Sandra Halperin

Sandra Halperin Nicholas W Fuller

Nicholas W Fuller Gerald Zaltman

Gerald Zaltman Bernard Keane

Bernard Keane Bette Lee Crosby

Bette Lee Crosby James Fenimore Cooper

James Fenimore Cooper Robert Hedin

Robert Hedin Dennis Ross

Dennis Ross Emma Shortis

Emma Shortis William Robertson

William Robertson Michelle Murphy

Michelle Murphy Yaagneshwaran Ganesh

Yaagneshwaran Ganesh Sheila Rowbotham

Sheila Rowbotham

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Willie BlairEncyclopedia Brown and the Case of the Jumping Frogs: A Thrilling Detective...

Willie BlairEncyclopedia Brown and the Case of the Jumping Frogs: A Thrilling Detective...

Floyd PowellA Journey Through the Lyrics of "Want to Play with the Sun" by Everclear: A...

Floyd PowellA Journey Through the Lyrics of "Want to Play with the Sun" by Everclear: A... Julio CortázarFollow ·9.4k

Julio CortázarFollow ·9.4k Cody BlairFollow ·16.8k

Cody BlairFollow ·16.8k Charles BukowskiFollow ·3k

Charles BukowskiFollow ·3k George Bernard ShawFollow ·12.7k

George Bernard ShawFollow ·12.7k David Foster WallaceFollow ·11.1k

David Foster WallaceFollow ·11.1k Banana YoshimotoFollow ·12.7k

Banana YoshimotoFollow ·12.7k Boris PasternakFollow ·19.2k

Boris PasternakFollow ·19.2k Walter SimmonsFollow ·11.5k

Walter SimmonsFollow ·11.5k

Ralph Waldo Emerson

Ralph Waldo EmersonBWWM Enemies to Lovers Billionaire Romance: A Captivating...

In the realm of romance novels, the...

Maurice Parker

Maurice ParkerJohn Adams and the Fear of American Oligarchy

John Adams, a...

Bryce Foster

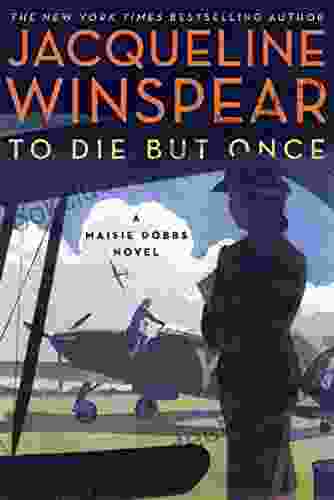

Bryce FosterTo Die but Once: A Haunting Maisie Dobbs Novel

Synopsis ...

Manuel Butler

Manuel ButlerCommunication Research Measures Sourcebook Routledge...

Communication research measures are the...

4.5 out of 5

| Language | : | English |

| File size | : | 1587 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 257 pages |

| Screen Reader | : | Supported |

| X-Ray | : | Enabled |